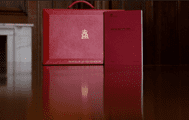

March 2024

1. Higher rate of property Capital Gains tax will be reduced from 28% to 24%.

2. 'Multiple Dwelling Relief', which is a Stamp duty relief for people who purchase more than one dwelling in a single transaction, will be scrapped.

3. The Furnished Holiday Lettings regime will be abolished as it created "a distortion meaning that there are not enough properties available for long term rental by local people", which should aid more landlords favouring typical rental set ups as opposed to short term holiday lets.